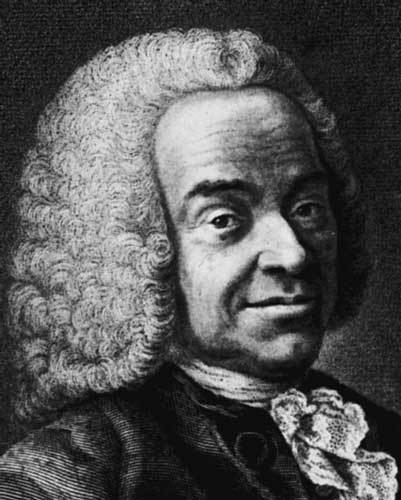

4th June 1694 – 16th December 1774

4th June 1694 – 16th December 1774

Leading figure in the Physiocrat school of economics, one of the first distinct schools of thought. His Tableau Economique (Economic Table) was one of the first systematic analyses of the circular flow of income in an economy. He was also noted for his early criticism of mercantilism and his focus on agriculture as the source of value in the economy.

5th June 1723 – 17th July 1790

5th June 1723 – 17th July 1790

Almost universally considered to be the father of economics, Smith's work revolutionised the subject. He is best known for his discussion of how people working in their self-interest within free markets may produce a socially beneficial outcome (the so-called "invisible hand", although Smith did not use the term when describing this). He also illustrated the benefits of intra- and international trade, and the increased efficiency that arises from division of labour. He travelled fairly frequently, but most of his life was spent either teaching at Glasgow University or at his home in Kirkcaldy.

13th February 1766 – 23rd December 1834

13th February 1766 – 23rd December 1834

Malthus is perhaps best known for his gloomy prediction that population growth would tend to outstrip economic growth, leading to the persistence of poverty and starvation. The failure of this prediction has discredited him, but Malthus made many other important contributions to economics; he was the first to clearly distinguish between demand and quantity demanded, and he was one of the few classical economists who researched the idea of a business cycle and the idea that Say's Law (supply creates its own demand) might not hold. He spent most of his academic life as Professor of History and Political Economy at the East India Company College in Hertfordshire.

18th April 1772 – 11th September 1823

18th April 1772 – 11th September 1823

Most famous for his work on comparative advantage, the mathematical reasoning proving that free trade between countries always benefits both countries. Also gave the first clear explanation of the Law of Diminishing Marginal Returns, and was an early exponent of the quantity theory of money (increases in the money supply will increase prices by the same amount). He also argued that landowners would receive rent due to the scarcity of land, which was effectively money for nothing. Never an academic, but made a fortune as a stockbroker, and in the last few years of his life became an MP.

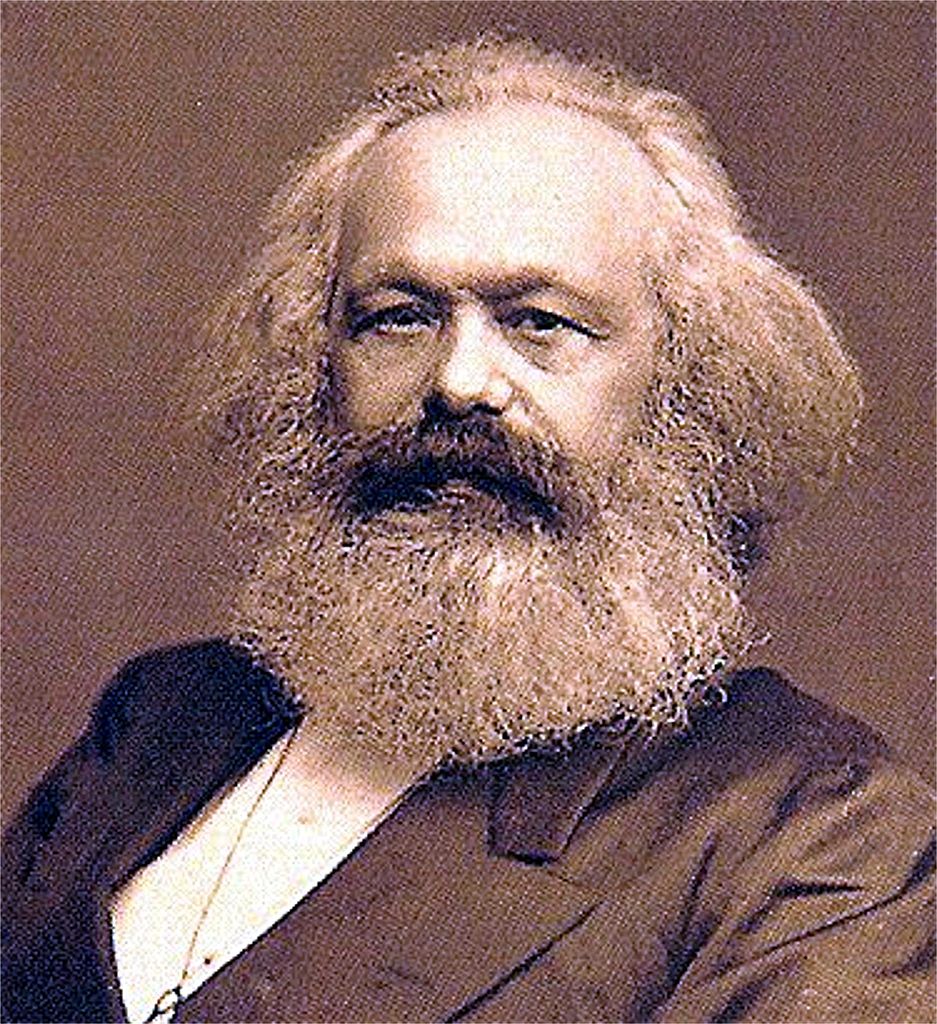

5th May 1818 - 14th March 1883

5th May 1818 - 14th March 1883

Marx is undoubtedly the most controversial figure in the history of economics, but the failures of twentieth-century Communist regimes should not be used to discredit Marx's economic thought. Marx was the first to argue that crises, and the business cycle, were an unavoidable part of capitalist economies. He was one of the first to describe the transformative impact of the Industrial Revolution, and the importance of innovation in the economy. He also inspired the heterodox Marxian school of economics, which focuses on capitalism's tendency to crisis and is based on Marx's less mainstream ideas, such as the tendency for the rate of profit to fall and the labour theory of value. He spent much of his life in London, from where he led the international Communist movement.

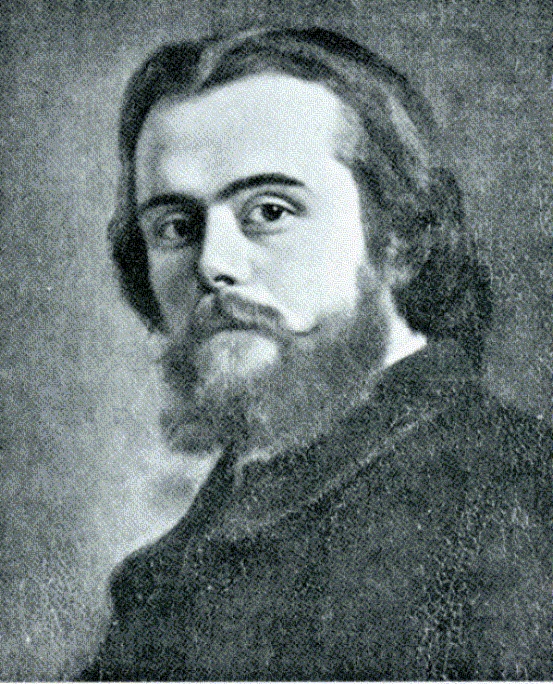

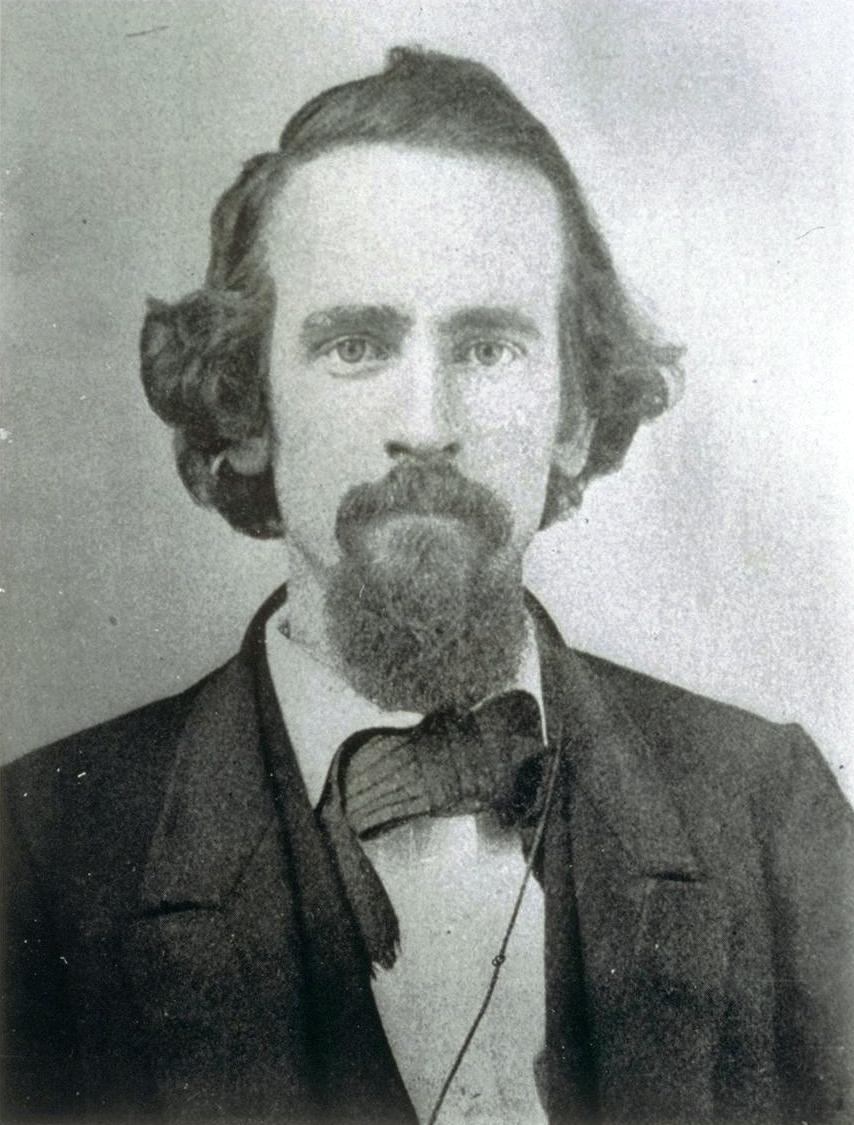

1st September 1835 - 13th August 1882

1st September 1835 - 13th August 1882

William Stanley Jevons was one of the three leaders of the Marginal Revolution, along with Leon Walras and Carl Menger. Jevons developed the theory of marginal utility - that the value of a good is determined by the amount of pleasure caused by the next additional unit of that good. This was based on the philosophical concept of utilitarianism developed by Jeremy Bentham and John Stuart Mill. He was trained as a natural scientist and brought a scientific approach to economics, including the belief that economics should use mathematics. He also observed the so-called Jevons paradox, that the use of energy tends to increase when energy efficiency is increased, as the cost of energy is reduced. Jevons taught at Owens College, Manchester (now the University of Manchester) and University College London.

16th December 1834 – 5th January 1910

16th December 1834 – 5th January 1910

Walras was one of the three leaders of the Marginal Revolution, along with William Stanley Jevons and Carl Menger. As well as working on the concept of marginal utility, Walras is best known for his work on general equilibrium - analysing a system where the market for every good, and all economic variables, are in a state of equilibrium. Before Walras, there had been little analysis of the way that different markets interact. He also simulated a process by which this equilibrium might be reached, similar to an auction, which he referred to as "tâtonnement". Walras spent most of his career as Professor of Political Economy at the University of Lausanne.

2nd September 1839 – 29th October 1897

2nd September 1839 – 29th October 1897

George was a popular rather than an academic economist, but was extremely influential in his time. Most of his writings were on the nature and importance of land in the economy. He was a noted advocate of a tax on the unimproved value of land, on the grounds that it would not have any economic distortions but could still raise revenue. He believed that speculation on land was at the root of economic instability and a drain on the economy. He lived in California and later New York City, where he wrote, spoke and occasionally stood for election to various offices, though he was never elected.

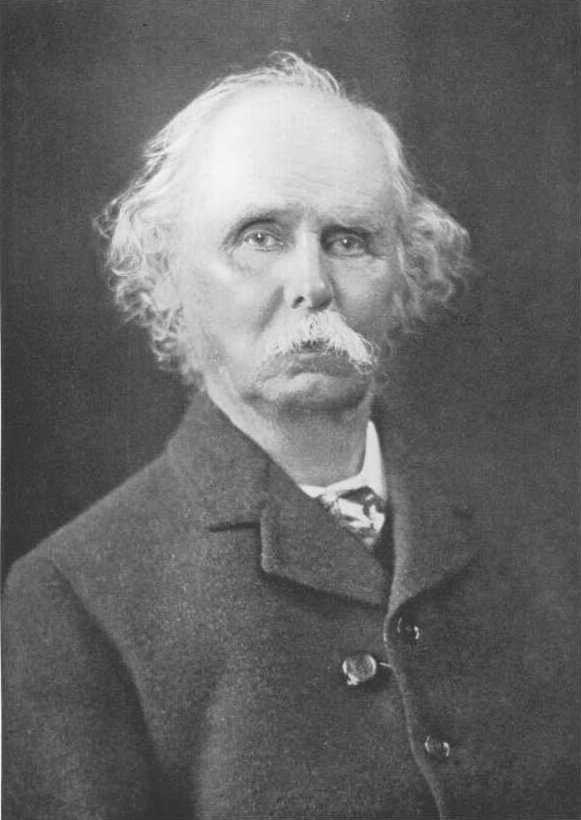

26th July 1842 – 13th July 1924

26th July 1842 – 13th July 1924

Marshall is best known for his textbook, Principles of Economics, which had a great influence on the study of economics for the next 50 years. It popularised the Neoclassical ideas of Jevons and Walras, particularly the idea of marginal utility, as well as Cournot's supply and demand diagrams. Marshall also contributed many new ideas in his textbook, including the ideas of elasticity (the responsiveness of one factor to another factor, such as price and demand), and the short and long run. Marshall spent most of his career as Professor of Political Economy at Cambridge, where he taught many leading economists of the 20th century, including Keynes.

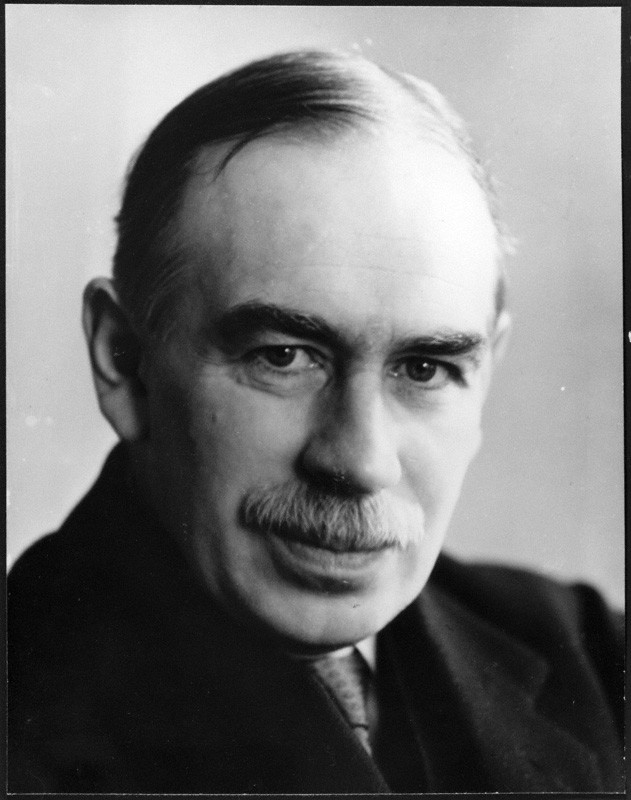

5th June 1883 - 21st April 1946

5th June 1883 - 21st April 1946

Keynes is almost certainly the most important economist of the Twentieth Century. His General Theory transformed mainstream thought about the management of the economy, and had a strong influence on economic policy both in the 40 years following its publication and in 2008. His key contributions were the concept of aggregate demand, and the idea that a deficiency in this could lead to unemployment but could be cured by government policy. He also overturned the idea that the economy would naturally reach a low-unemployment equilibrium. Keynes studied and later taught at Cambridge University, as well as advising the British government on economic policy.

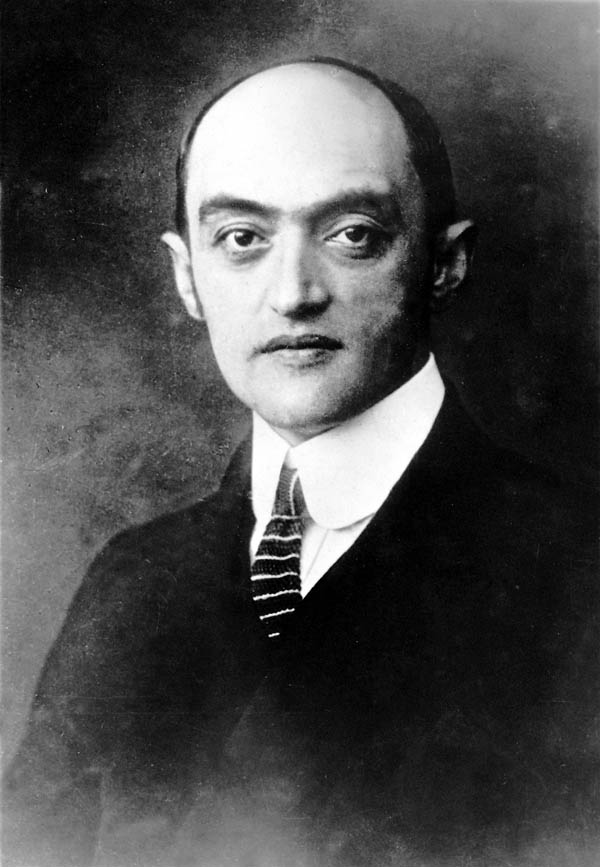

8th February 1883 - 8th January 1950

8th February 1883 - 8th January 1950

Joseph Schumpeter was an unorthodox economist of the early 20th century. He is best known for developing theory on the importance of innovation in a capitalist economy. Schumpeter argued that entrepreneurs and innovation were responsible for development in capitalism, preventing the economy from reaching the "steady state" predicted by Classical economists. He coined the phrase "creative destruction" to describe the process by which the creation of new products and techniques forces old, inefficient ones to be destroyed. He also argued that monopolies could be beneficial, as their higher profits meant they had more money to fund innovation. He also had an unusual theory of business cycles, attributing economic fluctuations to four different cycles, each of different lengths, which interact with each other. Schumpeter spent most of his career teaching at Harvard University.

23rd August 1931 -

23rd August 1931 -

Kenneth Arrow is best known in economics for his groundbreaking analysis of general equilibrium, which forms the basis for much of modern macroeconomics. With Debreu and McKenzie, he extended and formalised Walras' theory of general equilibrium. He also contributed to the theory of economic behaviour with uncertainty and asymmetric information, as well as work on the role of experience in increasing productivity. His best-known contribution, though it is less related to economics, is his Impossibility Theorem, which mathematically proves that no voting system can provide a ranking of options that satisfies the desires of a whole community. He has spent most of his career at Stanford University.

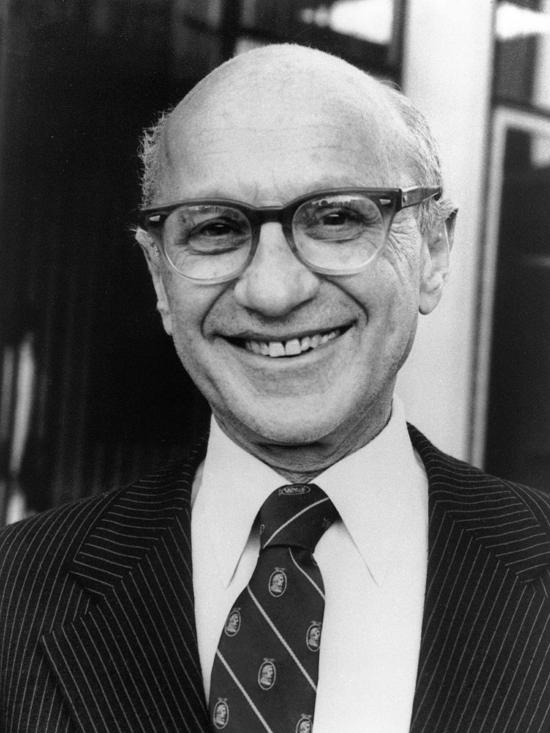

31st July 1912 - 16th November 2006

31st July 1912 - 16th November 2006

Milton Friedman was a prominent advocate of monetarism, the theory that changes in the money supply played an important role in determining the real level of output. A Monetary History provided evidence of the importance of monetary policy from 100 years of American history. He also disputed the Keynesian idea that individuals have a constant marginal propensity to save in favour of the so-called 'permanent income hypothesis' which states that people spend a particular proportion of their expected income over their lifetime. He won the Nobel Prize in 1976 for both of these achievements. Friedman taught for most of his life at the University of Chicago.

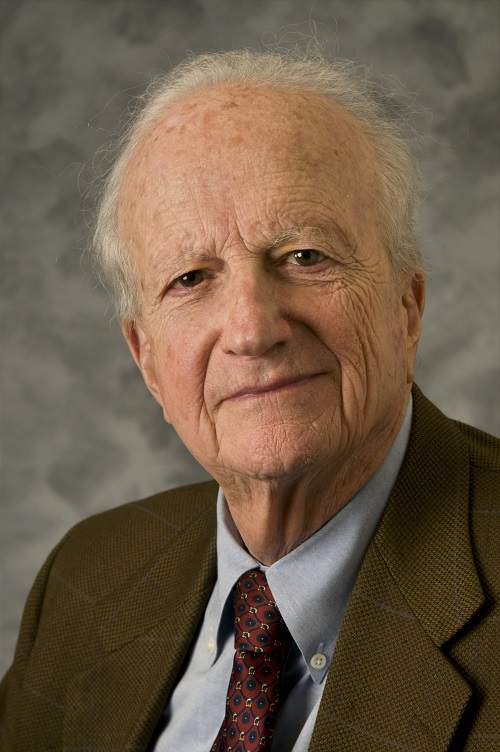

2nd December 1930 - 3rd May 2014

2nd December 1930 - 3rd May 2014

Gary Becker greatly expanded the horizons of economics, by applying economic analysis (specifically neoclassical rational choice theory) to many non-economic aspects of life. One of his first works was on discrimination, and argued that discrimination in the labour market is harmful to the discriminating employer. He also produced a rational model of how people decide between work and leisure, argued that the decision to commit crime is a rational choice made by weighing up the costs and benefits of breaking the law, and later sought to explain the existence of families and addiction based on rational choice. He taught at the Universities of Columbia and Chicago for most of his career.

15th September 1937 -

15th September 1937 -

Robert Lucas is one of the most important economists of the last 50 years. He introduced the concept of rational expectations - the idea that people generally have realistic expectations about what will happen to the economy - which transformed the study of macroeconomic policy, as it meant that the government could not consistently fool the public about their intentions. He also contributed the Lucas Critique, based on rational expectations, which argued that historical data cannot be relied on for economic modelling, as people would eventually change their expectations if the government relied on past economic relationships. He has taught at the University of Chicago for the past few decades.